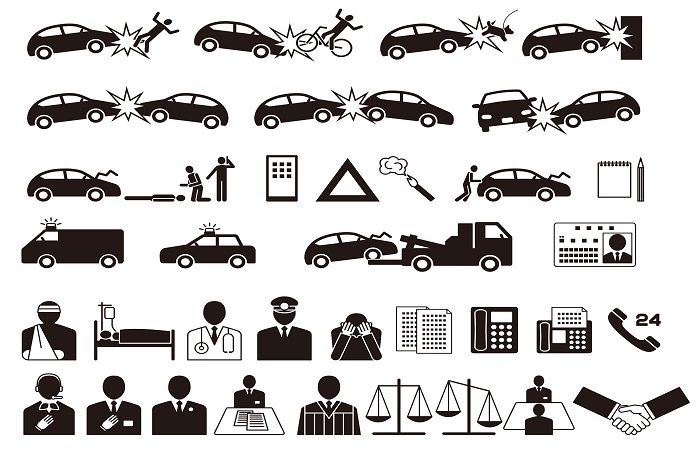

What is a Car Accident Settlement Process

There is only a small percentage of car accident cases that go to court. The majority of the cases are resolved through car accident settlement. This is because most of the cases can be resolved without the need for a lawsuit.

What is a car accident settlement?

If you have been in a car accident which resulted in damage to your car or that someone got hurt as a result of this accident, then you will most probably have to file an insurance claim. When this claim is settled between the parties involved without the case going to court, it is a car accident settlement.

Car Insurance Types

With the exception of the states of Virginia and New Hampshire, it is mandatory that all drivers carry auto insurance. There are two types of car/auto insurance systems:

- At-Fault System

This is the traditional type of insurance plan, where the party that is at fault has to pay for the damages. Once fault has been established, you can:

- File a claim for damages with your own insurance company

- File a claim for damages with the other party’s insurance company. This is called a third party claim.

- File for a lawsuit against the driver who caused the accident. However, keep in mind that if you sue the other party, you leave yourself open to a counter-suit.

- No-Fault System

In the case of no-fault systems, you file a claim to collect damages for medical expenses and/or lost wages no matter whose fault it was. Your insurance company is responsible to pay you for damages up to the limit of your insurance policy. Under this system, neither party can sue.

Car Accident Settlement Process

The reason why the majority of cases don’t go to trial and are settled between parties involved in the car accident and their insurance companies is because a jury trial does not guarantee a favorable outcome for you. When you do a settlement, you will recover some damages for your medical bills, any loss of wages, as well as the pain and suffering you went through as a result of this accident.

Here is a brief description of the car accident settlement process:

- Gathering of Information

To be able to file for a car accident insurance claim, you need to first get all the evidence and information about the accident together. This means collecting all relevant medical records, medication as well as treatment bills, testimonies from those who witnessed the accident and relevant photographs.

- Demand Letter

This is a summary of your claim and damages. In the letter, you should state your claim, explain your injuries and also state what you expect in damages. A well-drafted demand letter makes all the difference in the settlement process, so take your time composing it.

- Claims Investigation

Once you have submitted your claim, the insurance company will investigate it. If your claim is approved, then you will be given a settlement offer.

- Negotiation of Settlement

Once the settlement offer is made, then all parties can negotiate the car accident settlement.

Drafting a Complaint

In the event of the insurance company denying your claim, then will probably be allowed to make an appeal to the claims adjuster.

Suing the other driver

If you decide that you want to sue the other driver for damages, then you will need file an initial complaint in the district/county court.

Remember, there is a statute of limitations, meaning there is a time limit within which you can file a claim in a car accident settlement case.