Brian Melzer - Miami, FL

Brian Melzer - Miami, FL  Rose Kinley - Austin, TX

Rose Kinley - Austin, TX  George Mattis - Las Vegas, NV

George Mattis - Las Vegas, NV  Mary Dale - Boston, MA

Mary Dale - Boston, MA With Stormy Economic Times Ahead, Americans with Retirement Funds are Jumping on Gold

US residents may be eligible for a gold retirement account for protection against economic downturns

Given recent alarming economic events, Americans are looking for a secure way to protect their funds in case of a market collapse. Gold has always been popular with investors, and now the average person should consider its solid value when planning for the future. Given recent events with Iran, China, Russia and the exploding US spending deficit, markets are at risk of dramatic collapse and investors can lose money in a moment’s notice. It’s always crucial to diversify your portfolio, and you should include a stable segment such as gold in your IRA.

Eligibility for a gold IRA varies on a number of factors such as your current age. Over 101,879 people have already checked if they are eligible for a gold IRA to protect their retirement, and it takes less than one minute to answer a few basic questions.

You can run an eligibility check for a gold IRA by selecting your age group below:

These are some of the reasons the US economy may face incredible challenges in the near future:

1 – Turmoil in the Middle East

With the withdrawal of the United States from the nuclear agreement with Iran, there’s a very high probability things are going to get messy in the Middle East. This can cause oil prices to skyrocket and hurt the global economy.

2 – Record US National Debt

If you’ve been following recent news, US national debt keeps growing dramatically and has risen to a staggering record of $21 trillion, higher than the entire US economy! This is a troubling concern because economic disaster could hit the markets and cause a collapse of value for those holding financial assets.

3 – China Trade Wars

In addition to the internal turmoil in the US, you must consider the growing talk of a trade war with China which in effect has already begun. Tariffs against China sent the Dow plummeting, which could worsen in the months ahead as China retaliates against the US. The result could be increased inflation and a major recession, which would impact people in all economic levels.

4 – Rising Tension with Russia

In addition, rising tensions with Russia, a major superpower, could lead to a global economic disaster due to conflicts of interest in the Middle-East and around the world.

In a worst-case scenario, investors could be left with stocks that have little or no value, with vast retirement savings wiped out.

A little known section of the IRS tax code (408-m3) allows you to open a Precious Metals IRA and put REAL gold and silver into a tax-advantage account.

There are 4 very important reasons to consider this IRS tax advantage:

1 – As opposed to stocks, gold will ALWAYS be worth something even in an economic collapse

2 – Gold keeps it’s value when the dollar is devalued

3 – Gold has outperformed stocks by six times in the past 18 years

4 – Gold is a global currency, protecting you from a dollar collapse

Because of the reasons above and countless other risks, every responsible investor who has a retirement account must educate himself further about carving a segment of their savings in gold.

Investing in Gold

Gold is well-recognized as a safe investment in troubled economic times. It isn’t impacted in the same way as the rest of the markets because it doesn’t revolve around one country’s economic stability. In the last 15 years, gold has increased by an amazing 300 percent. No other investment can give you that kind of impressive return.

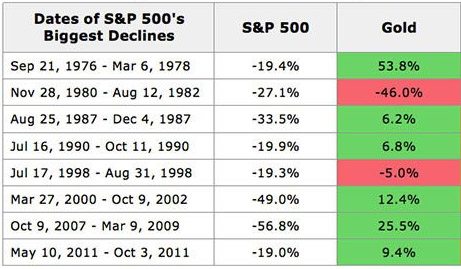

Gold Value Normally Increases During Stock Market Crashes

One of the reasons gold has remained stable is because it’s tangible. You can hold it in your hand and know it exists. Other investments are just numbers listed on the stock exchange which can go up or down.

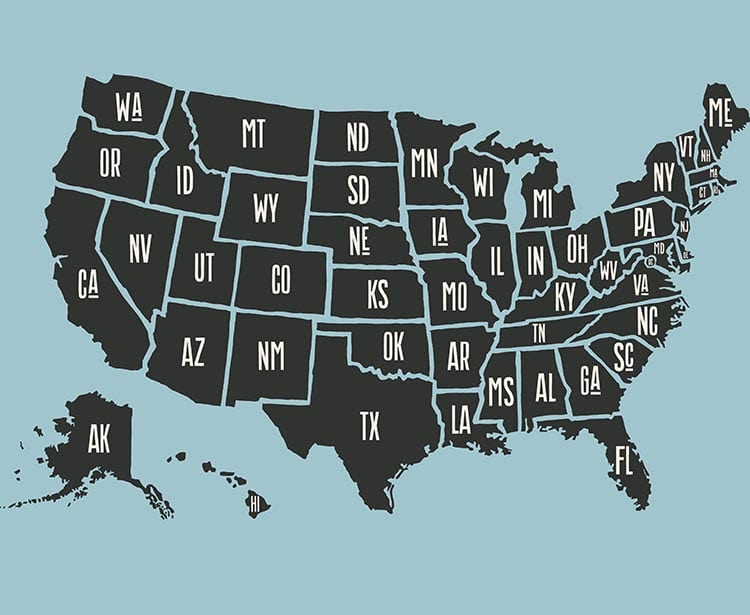

You can check if you are eligible for a gold IRA by selecting the state you reside in below:

Gold for Retirement

Gold is one of the best investments you can make for retirement. As you get older, you want to choose less risky investments so you don’t lose all your money in an economic downturn. You don’t have time to recoup your losses, which means you would be left without a retirement fund. Unlike other investments, gold doesn’t lose value. In fact, when there’s economic instability, gold’s value increases.

Regardless of whether you currently invest in the stock market or prefer commodities, it’s always good to add some gold to your portfolio. If you invest in real estate, you know how potential falling prices can negatively affect you as they did in 2008.

Traditional retirement plans may not allow you to invest in gold because it’s a real asset. You must have room for physical storage. Gold also requires insurance and special security as well as custodial issues. To enjoy the benefits of a gold investment, you need a gold IRA.

People who are investing and saving for retirement want a portfolio they can count on. They don’t want to worry when the economy suffers from global downturns. Gold is safe and won’t have wild fluctuations or be impacted by inflation. Even when other currencies are devalued, gold will hold it’s worth or even increase in value.

Experts Say “Buy Gold”

Financial experts often disagree about the best approach to achieve financial success and independence in your retirement. However, they will all agree on one thing: gold is a good choice for retirement portfolios.

Performance coach Tony Robbins has turned his attention to wealth and finance recently and even wrote the book, Money: Master the Game, to help others in their quest for financial security. His advice to investors today? Start planning now for an impending crash. Even though Wall Street has been strong in recent years, a downturn is inevitable, especially as markets are currently peaking.

Tony Robbins said in a Fortune article, “the best offense is a good defense.” For many investors, that defense is gold, which can withstand changes better than most other investments and isn’t tied to any single economy or currency.

If you want to be prepared for economic uncertainty and enjoy retirement with an adequate income, gold is the investment you should consider. Look at a Gold IRA to help you have the money you need for a secure future.

Check now if you are eligible for a gold retirement account, it’s 100% free

There is no promise or representation that you will make a certain amount of money, or any money, or not lose money, as a result of using our products and services or any product or service that we recommend on this site. Any earnings, revenue, or income statements are strictly estimates. There is no guarantee that you will make these levels for yourself. As with any business, your results will vary and will be based on your personal abilities, experience, knowledge, capabilities, level of desire, and an infinite number of variables beyond our control, including variables we or you have not anticipated. There are no guarantees concerning the level of success you may experience. Each person’s results will vary. There are unknown risks in any business, particularly with the Internet where advances and changes can happen quickly. The use of our information, products and services should be based on your own due diligence and you agree that we are not liable for your success or failure. Disclosure: We are a professional review site that receives compensation from the companies whose products we review and recommend. We are independently owned and the opinions expressed here are our own.